Nuclear energy is emerging as a surprising beneficiary in tandem with the booming infrastructure of artificial intelligence (AI). As major technology firms like Nvidia, Advanced Micro Devices, and Taiwan Semiconductor Manufacturing lay the groundwork for generative AI with essential hardware, cloud giants such as Microsoft, Alphabet, and Amazon are rapidly expanding their data center capabilities. Amid this landscape, one company that stands out is Oklo, which has seen its stock soar an incredible 1,130% over the past year.

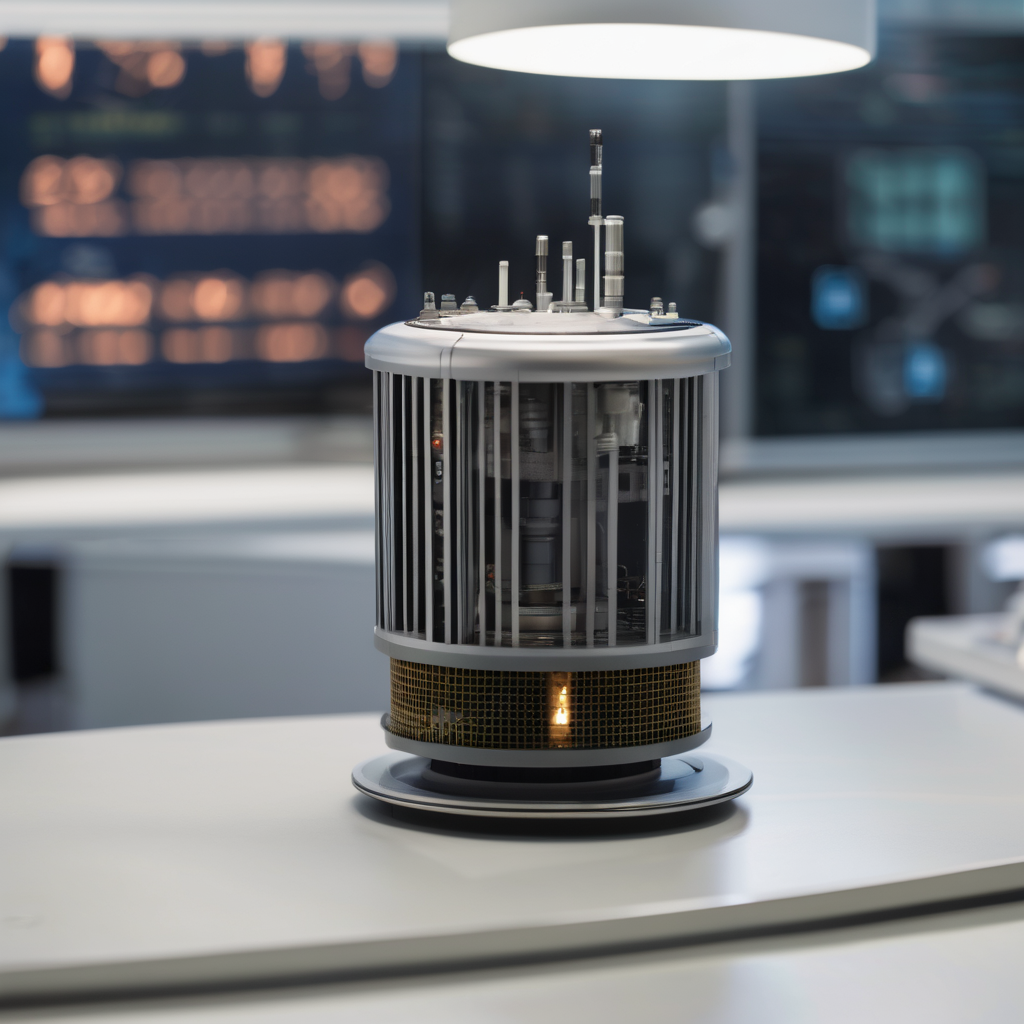

Oklo is focused on developing small modular reactors (SMRs) that could power data centers and remote industrial locations. This innovative approach has captivated investors, especially as the growing demand for electricity, particularly driven by AI’s expansion, has created a market valued by Wall Street at potentially $10 trillion. However, despite Oklo’s impressive stock performance, the company is still grappling with a lack of revenue and profits.

Looking ahead to 2026, analysts predict that Oklo’s trajectory will center on forming strategic partnerships rather than generating profits. The company is expected to announce new collaborations with government bodies and private enterprises, including data center operators seeking to diversify their energy sources. While such partnerships will attract media attention and enthusiasm from the public, they may not translate into immediate financial gains for investors. Oklo’s future heavily relies on its ability to deploy and operate a fully functional reactor, which is still years away.

As Oklo’s stock continues to rise, concerns about its high valuation linger. The company’s market capitalization has ballooned to $20 billion since it went public via a special purpose acquisition company (SPAC) in 2024, despite not generating any revenue. This disconnect may compel the management to seek additional capital via a secondary stock offering, a move that could result in dilution of shares and is common among early-stage companies.

Investors need to approach Oklo with caution, as the company has increasingly been viewed as a speculative investment rather than a solid long-term opportunity. Its current market sentiment resembles that of a meme stock, characterized by optimism rather than tangible business fundamentals. As seen during the dot-com boom, valuations driven by hype can often lead to corrections when expectations aren’t met.

Though Oklo could potentially play a pivotal role in the future of nuclear energy, its success depends on technological advancements and financial stability. Until those uncertainties are resolved, investors might find themselves in a high-risk scenario. For those considering an investment in Oklo, it may be wise to monitor developments closely and remain wary of the inevitable dramatic fluctuations that often accompany stocks riding the wave of speculative fervor.