In a significant development within the semiconductor industry, Nvidia has finalized its purchase of 214.7 million shares of Intel at a price of $23.28 per share, amounting to a $5 billion equity investment originally announced in September. This deal, which was granted the green light by the Federal Trade Commission in December, represents a crucial lifeline for Intel amid its recent struggles. However, the purchase price currently stands 36% below Intel’s recent trading figures, reflecting a challenging market environment.

At present, Intel holds a market capitalization of approximately $172.67 billion, demonstrating a remarkable rebound from the lows experienced in 2024 and early 2025, when its valuation dropped to around $82.71 billion. This resurgence can be attributed in part to Intel’s ongoing investments aimed at bolstering its technological capabilities, despite significant capital expenditures that have put pressure on its financials over the years.

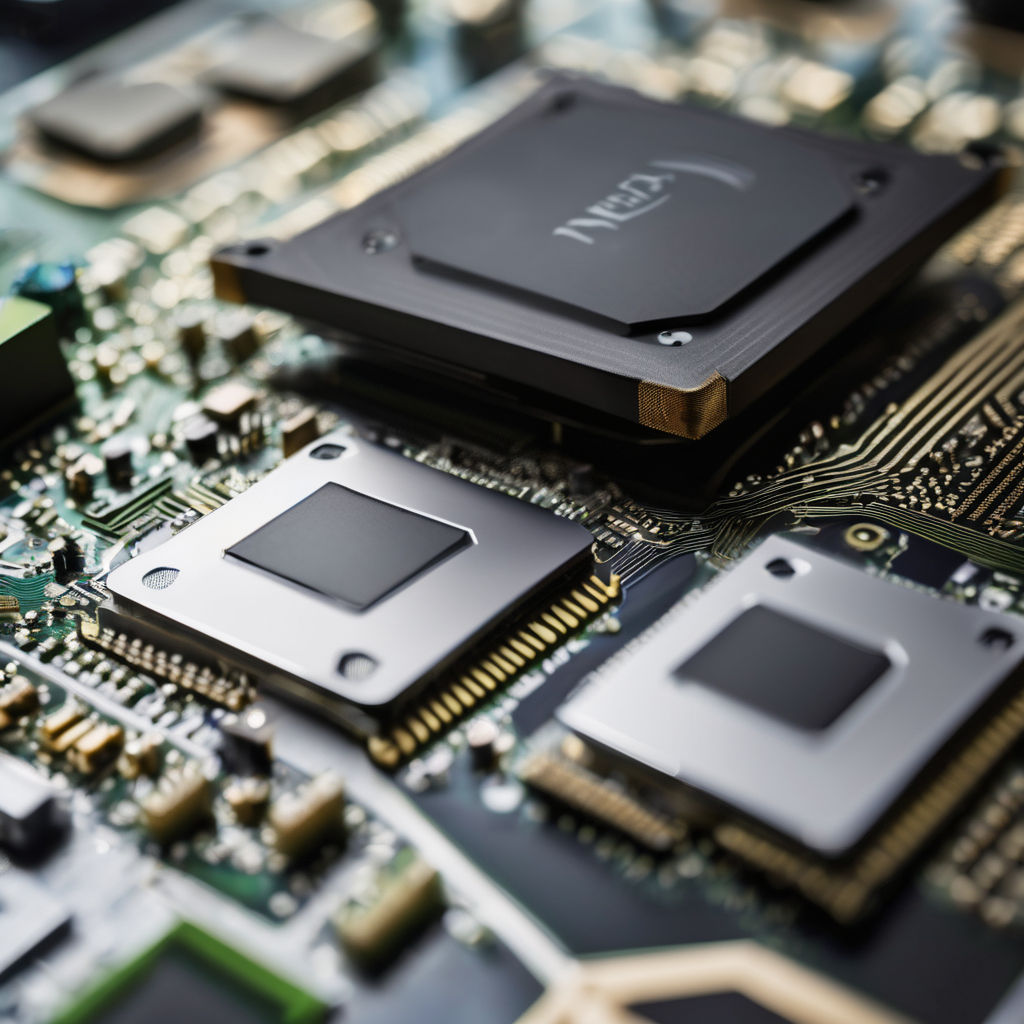

Interestingly, the partnership forged between Intel and Nvidia extends beyond financial transactions; it has also led to the development of the Intel x86 RTX System-on-Chips (SoCs). While these products are not a direct outcome of the recent governmental investments, the collaboration highlights a strategic alignment that had been in progress prior to the U.S. government’s involvement, signaling a long-term vision for both companies.

The anticipated launch of the RTX SoCs remains undefined at this stage, yet their arrival could herald a transformative moment in the semiconductor market, especially as Intel adapts and evolves under its revitalized leadership. Moreover, Intel’s foundry services are gaining momentum, positioning the company to contend more directly with industry leader TSMC’s operations in the U.S., aided by its early investment in High-NA EUV lithography technology.

As this dynamic evolves, the tech world watches closely, hopeful that these developments may spark a new era of innovation and competition in the semiconductor sector.