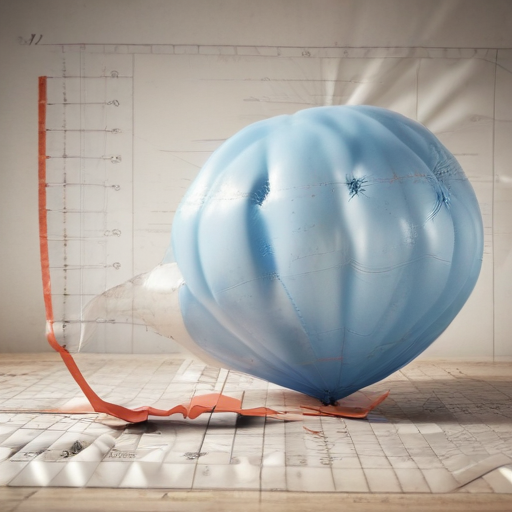

Inflation unexpectedly accelerated in January, presenting an early test to President Donald Trump’s economic policies. The Bureau of Labor Statistics (BLS) reported that core inflation, which excludes volatile food and energy prices, increased by 3.3% over the past year, surpassing economists’ predictions of a 3.2% rise. The month-to-month measurement also exceeded expectations, rising by 0.4% compared to a forecast of 0.3%.

Since regaining the White House, Trump has promised to tackle inflation promptly, even claiming he would start from “Day One” of his term. However, just 24 days into his presidency, he placed the blame for inflation on his predecessor, referencing “BIDEN INFLATION UP!” on his Truth Social platform. Despite the BLS report’s survey beginning before Trump took office, the data indicates that curbing inflation may be more challenging than anticipated.

Notably, egg prices surged by more than 15%, marking the highest increase since 2015, driven by a bird flu outbreak. Housing, vehicle insurance, airfares, and education costs also saw upticks, although some sectors, like appliances and furniture, experienced price declines, potentially due to post-holiday sales.

Consumer spending trends also suggest a pullback; for instance, McDonald’s reported its largest sales decline since the pandemic began, despite a slight increase in customer traffic and overall spending. Alongside rising airline ticket prices, many low- and middle-income families are reconsidering their travel plans. Even alcohol sales have witnessed a downturn.

The markets reacted negatively to the inflation report, with the Dow Jones Industrial Average dropping by around 400 points at the start of trading. Increased borrowing costs were seen as the yield on the 10-year U.S. Treasury bond rose.

In response to the inflation data, Trump urged on Truth Social that interest rates should be lowered, claiming it would align with impending tariffs. Lowering interest rates may boost consumer and business spending but could also risk reigniting inflation.

Amid these developments, Trump’s economic adviser Kevin Hassett noted that the administration might need to curb consumption, which could lead to slower growth and possibly higher unemployment rates. This draws attention as markets appear to be more focused on the uncertainty stemming from Trump’s trade policies. The president recently imposed 25% tariffs on steel and aluminum imports—a decision that some businesses warn could lead to further price increases. He also announced a 10% tariff on all goods from China, which elicited a retaliatory response.

Insights from Bank of America analysts suggest that Trump’s trade, fiscal, and immigration policies could prove mildly inflationary. Meanwhile, the Federal Reserve’s Chair Jerome Powell remarked that while the overall economy remains strong, the central bank plans to maintain higher interest rates longer to combat inflation. Powell indicated that the Fed could adjust interest rates depending on the future trajectory of economic growth and conditions.

Economic research by Neil Dutta points to an increase in uncertainty and a slowing economy, emphasizing that consumers are depleting their savings just as public spending is poised to decrease due to both federal and state budget constraints.

The combination of rising inflation and uncertainty in economic policies highlights the complexity of managing the U.S. economy moving forward. As businesses and consumers navigate these challenges, the positive spin is that there remains a robust discussion around policy adjustments that may foster stability and growth in the long run.