Hedge fund Citadel has dramatically increased its stake in D-Wave Quantum, acquiring more than 200% more shares last quarter. This move reflects Citadel’s ongoing interest in quantum computing, a field that has garnered significant attention from investors and analysts alike.

Founded by Ken Griffin in 1990, Citadel has established itself as a powerhouse in hedge fund management, delivering compound annualized returns of nearly 20%. This performance has consistently outpaced the S&P 500, affirming Griffin’s reputation as a top-tier investor.

Citadel’s recent 13F filing revealed that in the third quarter, the firm purchased 169,057 shares of D-Wave Quantum, boosting its ownership by 201%. Analysts covering D-Wave are optimistic about the company’s potential, with the average 12-month price target set at $38, indicating a possible upside of 59%. Notably, Nathaniel Bolton from Needham expresses even greater confidence, forecasting a price target of $48—an impressive 101% increase.

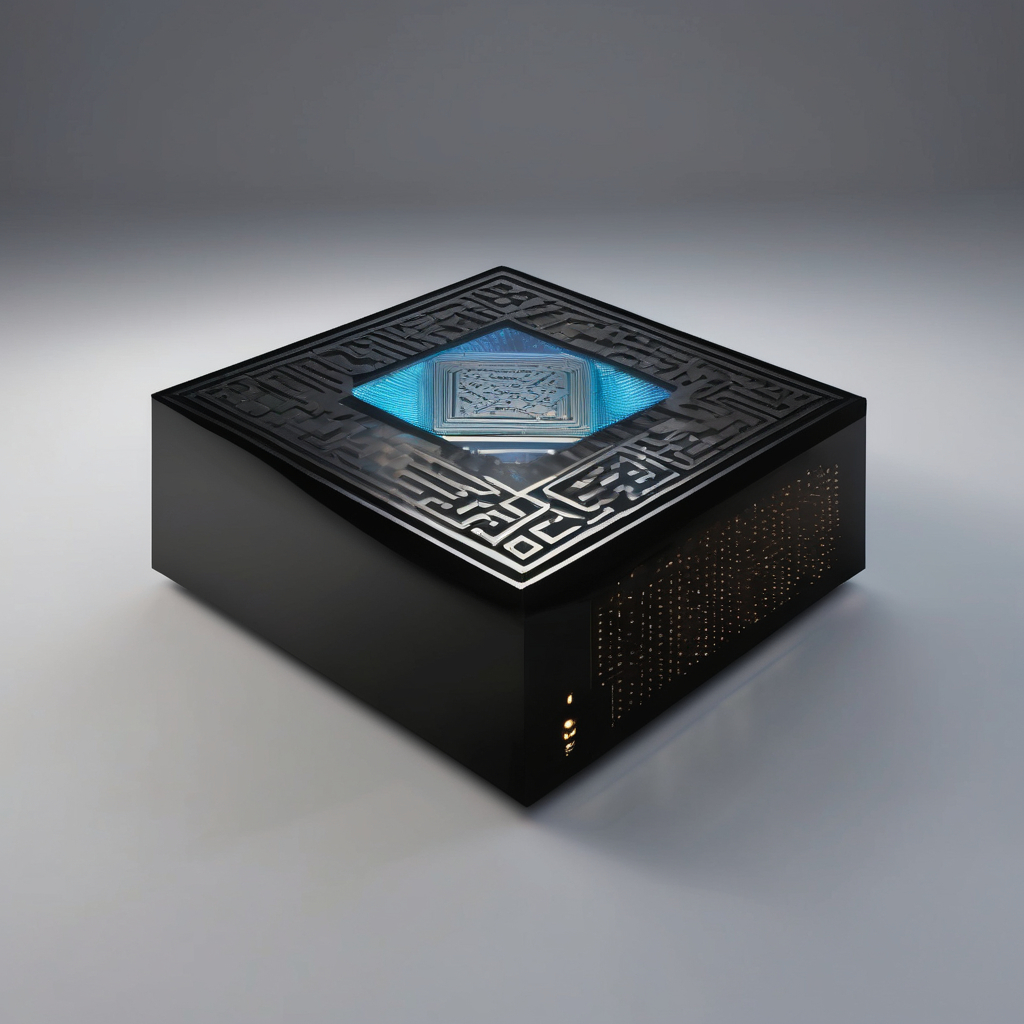

D-Wave Quantum is at the forefront of developing quantum computers using quantum annealing technology. This approach allows D-Wave’s machines to tackle specific optimization and probabilistic sampling challenges, which might exceed the capabilities of traditional supercomputers. Industries such as logistics, manufacturing, telecom, and city planning could greatly benefit from these advanced solutions.

However, despite promising use cases, D-Wave has faced challenges in achieving broader commercial adoption. The company’s revenue growth, although notable, is accompanied by considerable losses. The need for substantial ongoing investments in research and development poses risks for future profitability. The selling activity among D-Wave insiders, including top executives, raises concerns about the company’s financial trajectory and market confidence.

As Citadel holds both stocks and a mix of call and put options in D-Wave, the complexity of this strategy may not be suitable for ordinary investors. While following institutional investments can provide insights, it is crucial for retail investors to conduct thorough evaluations based on valuation metrics. D-Wave’s price-to-sales ratio, currently at 294, signals potential overvaluation. Lessons from the tech industry’s history suggest that excessive valuation multiples can lead to significant declines.

For those considering investments in the quantum computing sector, it may be wise to adopt a cautious approach. While day traders and those with a high-risk tolerance might find D-Wave appealing, there are other opportunities in the quantum space that offer less volatility and complexity for average investors.