China has announced a ban on exports of critical high-tech materials, including gallium, germanium, and antimony, to the United States. This decision is seen as a response to the recent expansion of U.S. export controls on Chinese companies regarding semiconductor-related technologies.

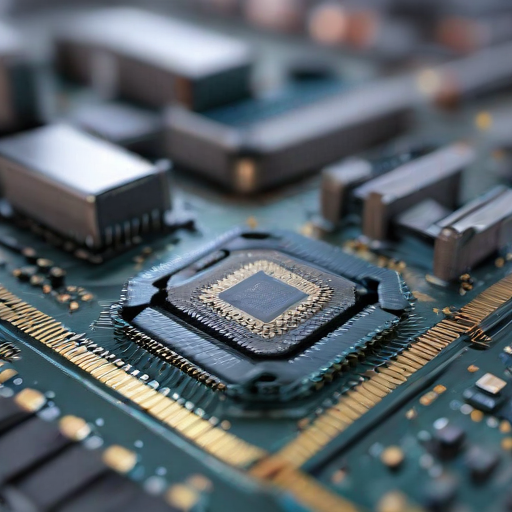

The Chinese Commerce Ministry’s announcement comes after the U.S. added 140 Chinese entities to its restrictive “entity list,” targeting companies involved in computer chip production, software development, and high-bandwidth memory. These chips are essential for a range of applications, including advanced technology sectors.

During a routine briefing, Lin Jian, a spokesperson for China’s Foreign Ministry, criticized the U.S. for what he deemed an overreach of national security measures that suppress China’s technological advancements. He stated that China firmly opposes unilateral sanctions and restrictive trade practices imposed by the U.S.

In recent months, China has already started requiring exporters to obtain licenses for sending these strategically important materials such as gallium, germanium, and antimony to the U.S. These minerals are crucial in manufacturing computer chips, batteries, and other advanced technologies. China’s restrictions now extend to super-hard materials like diamonds, which have broad industrial applications.

China produces the majority of the global supply of gallium and germanium—metals vital for producing solar panels, military technologies, and various consumer electronics. In 2022, China exported approximately 23 metric tons of gallium and has an annual production capacity of around 600 metric tons of germanium.

Both nations claim that their respective export controls are necessary for national security. The Chinese government has expressed frustration regarding U.S. restrictions on access to advanced technology but has been cautious in its retaliatory measures to prevent any disruption to its burgeoning tech industry. Industries in China have voiced their dissatisfaction with the U.S. controls, suggesting that they are hindering market dynamics and increasing costs.

Notably, the U.S. sources about half of its gallium and germanium metals from China. The export restrictions have already impacted prices, with antimony prices reportedly exceeding $25,000 per ton, and similar price increases observed for other critical minerals.

As the U.S.-China trade landscape continues to evolve, this unfolding situation may lead to further implications for tech supply chains globally. The heightened tensions highlight the critical importance of finding a balanced approach that safeguards national security while fostering international cooperation and trade stability.

On a hopeful note, this situation could incentivize both nations to explore new avenues for multilateral dialogue and trade agreements, potentially paving the way for a more balanced economic relationship in the future.